Who Owns Indy’s Houses: A Review of the Largest Single-Family Home Investors

Another brilliant report from Fair Housing Center of Central Indiana.

During the pandemic, out-of-state property investors “discovered” Indiana. What they discovered is a state with no real tenant protections and incentives for bad actor landlords to act with impunity. Indiana law invites “do-what-you-want” rental practices and investors realized our state is a cash cow. While most attention focuses on large, mutli-family housing units, the single-family market is no less effected and, in some ways, more so. Many don’t realize these properties are in their own neighborhoods - falsely driving up the tax base and inevitably driving down property values. This isn’t just a poor-people, Indianapolis problem. It affects everyone.

At the end of 2022, ATTOM Data put Indianapolis in the top 10 cities for institutionally owned rental properties. We are on track to be in the top 5 by the end of 2023.

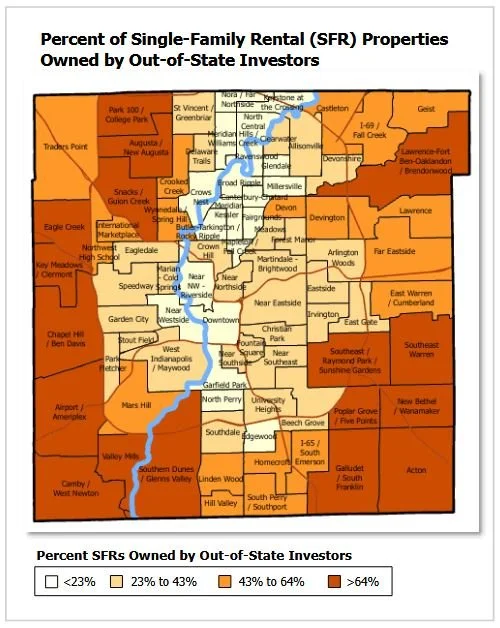

“We have a housing crisis in Indiana. Fewer and fewer Hoosiers own their homes while out-of-state investors have and continue to buy single-family homes in record numbers. The American dream of homeownership has turned to that of being a long-term renter. This problem is particularly acute in Indianapolis. At the time we pulled the data for this report, an estimated 27,000 single-family rental (SFR) properties in Marion County are now owned by corporate investors (LLCs, INCs, LLPs, REITs, etc). This activity, to date, is not slowing, with more purchases made every month. We estimate that around 13,000 (and growing) of these homes are owned by out-of-state investors. With each transaction is a loss of income, each month, of upwards of $15 to $20 million in rent payments1 that leave Indiana and disappear from our local economy.”